Blog

Structural changes cannot happen overnight in large markets. The signs are gradually becoming apparent, other markets are undergoing similar changes, and traditional cost and development structures must adapt: the internet has arrived. Furniture manufacturers no longer compete regionally, nationally, or across the country, but directly worldwide with wages, laws, offers, and intensive marketing.

Anyone in the furniture trade today who only has a business card, a website, and a store will not be able to survive in the long term. Furniture retailers cannot ignore the spirit of the times, and if they do, they will simply be overlooked in the flood of worldwide advertising. The increasing use of virtual decision-making aids, open comparisons, and inferior goods that are available at any time, online building instructions on YouTube, or reports described in forums encourage customers to do what seems economical for them: save money.

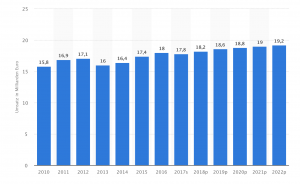

The Institute for Retail Research (IFH) predicts growth for the furniture market in the coming years. In recent years, total sales of furniture and furnishings in Germany have risen to just under 33 billion, with 9% generated by commercial sales and 91% by private consumption. The increase in sales of over 4% is similar to the average sales of the retail sector as a whole. In Switzerland and Austria, sales are reported at 11.5 billion each.

Forecasted sales development in the furniture industry in Germany from 2010 to 2022 (in billions of euros)

Source: statista.de

The following should be noted with regard to these figures: Almost 10% of total sales were generated through online and mail order, and this trend is rising rapidly. Buyers are looking specifically for details: they ask about the furniture designer and find out about materials and where the product was manufactured. Buyers are once again taking a greater interest in the philosophy behind the collection on display and the innovative force behind it. Anyone who purchases an online shop system for less than two hundred euros combines as many attributes and purchase terms as possible and sells furniture and decorative items at dumping prices on the Internet.

The internet gives the impression that everything is free. The internet itself is free; users usually only pay a monthly basic fee to their provider. Everything is available on the internet: films, music, books, love, and offers. Content is searched for, compared, and used to aid decision-making. Homo economicus, the time-consistent utility maximizer from business textbooks, checks his computer or cell phone and makes purchasing decisions between brushing his teeth and watching Netflix.

Millennials have already completely adopted these structures, as without a cell phone, it is no longer possible to reserve a restaurant, book a vacation, or purchase jeans. What the supposedly all-knowing Google or, in some cases, Bing suggests is briefly considered, compared, and purchased on a mobile device. Some still go to furniture stores, pick out a piece of furniture, sit on it, and then order it from otto.de, XXXLutz, or IKEA. The really brave ones click on the furniture offer at allibaba.com, the largest Asian online trading marketplace, and DHL will deliver it. This behavior is gradually being adopted by all age groups, and search engines are becoming the determinants of what is on offer. It is now irrelevant whether the supplier is amazon.de or zalando.de; search engines simply show the lowest price in the first row of search results and the lamp is purchased with a single click. Companies looking for goods also choose this purchasing model, as it is used by people who also purchase goods and services around the clock in their private lives. Cult, fashions, trends, and megatrends are explored and saved or ignored via Pinterest, Instagram, Facebook, and Twitter.

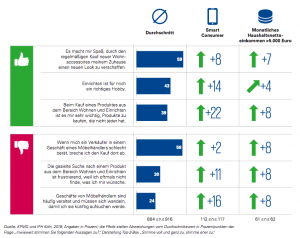

The megatrend, i.e., the long-standing focus on individualization, has been around for 20 years. However, megatrends could soon be referred to as mere trends, as the internet has a feature that no marketplace in history has ever had before: it is the fastest marketplace in the world. Today, upholstered beds and shower cubicles are the trend; tomorrow, it will be box-spring beds and floor-level showers. Manufacturers are finding that their designs are being offered as copies at low prices on ebay.de. Kitchen manufacturers, furniture stores, and carpet manufacturers are realizing that these furniture concepts have become obsolete. Craftsmen are receiving fewer orders to assemble sometimes complex furniture because instructions are freely available online in multiple formats, including text, images, and even videos. If something goes wrong during assembly, the manufacturer is blamed. Marketing in the industry is confusing, very extensive and cost-intensive due to constant changes, or as one seasoned marketing specialist said: After years in marketing, I would suddenly have to study computer science to keep up. In 2018, KPMG was able to Study “Set for the future” presents some interesting figures. To get ideas in the home & interior sector, 73 percent of study participants browse furniture retailers’ online shops, and 32 percent browse social networks. 30 percent find the targeted search for a product in the home & interior sector frustrating, both online and offline. One in three study participants therefore expects furniture retailers to offer an online availability check for brick-and-mortar stores. Three out of four consumers (76 percent) would prefer an online shop with a brick-and-mortar showroom to an exclusively online presence. Thirty-nine percent of study participants say they researched on Google or Amazon (35 percent) beforehand. A remarkable 37 percent of respondents researched online in advance at the retailer where they ultimately made their purchase in-store. What are SEO, keywords, benchmarks, impressions, CPC; why is the text identified as duplicate content, how should I create a catalog, why don’t we appear in the search engine when we type in the word “bedroom cabinet”?

On the one hand, search engine giant Google does not want to be influenced. To exert influence, you can buy it: you book advertising per click directly with the search engine in Google Ads. However, there are so many providers doing this, and they will be seen, provided they pay at least four-figure sums—monthly. The fact is that furniture customers are online. Statistically, more than half will search directly for home decor ideas or inspiration.

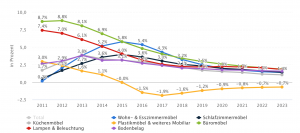

Changes in sales in the furniture market from 2011 to 2023

Source: statista.de

One in four customers buys online after exhausting their thirst for information. A high percentage of online customers in the furniture industry have high purchasing power with an income of over €3,000, and buying furniture online is very attractive to customers because it requires less effort, allows them to choose from the comfort of their own home, is available around the clock, provides a better overview of what is on offer, and offers free delivery with little effort. The share of e-commerce in the market is steadily increasing. There are labor laws, opening hours, and storage costs, to name just a few of the factors currently slowing down growth. Some retailers offer what is known as private shopping. Customers are catered to around the clock, Monday through Saturday. Any desired appointment with a specialist advisor can be arranged: simply call, book an advisor, and the customer can drop by again after work. This example shows that the challenge of digital transformation has been accepted and that retailers are reaching out to customers. It remains to be seen whether such concepts are viable and can provide customers with the latest design, material, and social trends for the interior design industry in the same way as the internet.

What can furniture retailers and marketplaces do? Improve their own product data with Onedot to achieve optimized time-to-market. Accurate master data and a shortened product roadmap stabilize market presence, increase findability on the internet, and ultimately lead to more sales.